How can you help Providence Catholic?

The Annual Fund 2025

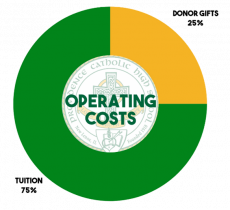

The Annual Fund bridges the gap between tuition payments and operating costs. A gift to the Annual Fund ensures that we are able to keep our college preparatory standard and reputation of excellence, often referred to as THE PROVIDENCE DIFFERENCE.

Gift Options

Credit Card – Select the Donate Now button above to make your donation securely online.

Check – Mail your check to PCHS c/o Advancement Office, 1800 W. Lincoln Highway, New Lenox, IL 60451

Stock Donation – In order to successfully complete this type of transaction, please notify Steve Cardamone, Director of Advancement, by letter, email, or phone (815) 717-3164 in advance to share the date of your incoming gift, the name(s) of the securities, the number of shares being transferred, and how you would like to designate your gift. Provide you Transfer Agent (Broker) with the following information:

- Broker Name: Atlas Wealth Management/LPL Financial (Attn: Steven Swanson)

- Address: 10257 W Lincoln Hwy, Frankfort, IL 60423

- Phone: (815) 464-8614

- Registration of Account: Providence Catholic High School

- DTC: #0075

- PCHS Account #7663-9030

If you own stock, it is often more tax-wise to contribute stock than cash. Gifts of appreciated stock are fully deductible. This is because a gift of appreciated stock generally offers a two-fold savings. First, you avoid paying any capital gains tax on the increase in the value of the stock. Second, you receive an income tax deduction for the full fair market value of the stock at the time of the gift.

In-Kind and Other Gift Sources – A Providence education will last a lifetime. Parents, families, and friends must be actively involved in order to maintain this program of quality education for today’s students, the adults of tomorrow. Your participation will make a difference. As a member of the Providence family, you can get involved through In-kind Gifts (Tax advantage).Providence purchases many supplies for its daily activities, events, and renovations. You or your company can help offset our expenses by donating product or merchandise to Providence. Contact Advancement for a letter verifying your In-Kind gift to the school.

Matching Gifts – Many employers support employee philanthropic giving by matching your contribution to Providence Catholic High School. In some cases, these matching gifts can double or triple your impact. To get started, simply speak with your Human Resources office, obtain the matching gift form, and mail it with your gift to Providence Catholic High School. A few matching gift companies we have worked with in the past are…

- RSM US

- Bank of America

- JP Morgan Chase

- Wells Fargo

- Southwest Airlines

- Arthur Gallagher Foundation

- Johnson & Johnson

- Axis Capital

- Goldman Sachs and Co.

- Ingredion

- Huron Consulting Group, Inc.

Donor Advised Funds – Donor Advised Funds (DAF) are a tax vehicle set up by a benefactor front loading charitable gifts to be paid in the form of grants to 501(c) 3 organizations. DAF is established through a bank, investment firm or community foundation. A donor-advised fund is like a charitable investment account, for the sole purpose of supporting charitable organizations. When benefactors contribute cash, securities or other assets to a donor-advised fund they generally are eligible to take an immediate tax deduction.

Real Estate – A gift of real estate can also be tax-wise. A residence, vacation home, farm, acreage or vacant lot may have so appreciated in value through the years that its sale would mean a sizeable capital gains tax. By making a gift of property instead, you would avoid the capital gains tax, and, at the same time, receive a charitable deduction for the full fair market value of the property.

Life Insurance – Gifts of life insurance can provide a significant charitable deduction. You could purchase a new policy or donate a policy that you currently own but no longer need. To receive a deduction, designate Providence as both the owner and beneficiary of the life insurance policy. Check with your insurance agent for the details.

Bequest -Providence can be named a beneficiary in your will. Assign an outright gift, either a designated dollar amount or percentage of your estate. Providence can also be named as a remainder beneficiary to receive funds only after specific sums have been paid to individual beneficiaries. Check with your attorney, accountant or other tax advisors for additional information on how these general rules apply to your situation and for more options.

Questions about giving? Contact Steve Cardamone, Director of Institutional Advancement at (815) 717-3164.